Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

The undercurrent of "selling the US dollar" is surging, and the bears remain silent, mysteriously turning their heads and shoulders hidden changes

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The undercurrent of "selling the US dollar" is surging, and the bears remain silent, mysteriously turning their heads and shoulders hidden changes." Hope it will be helpful to you! The original content is as follows:

Asian Market Review

On Wednesday, affected by concerns about the Trump administration's tax cuts and spending bills and weak demand for 20-year U.S. Treasury bids, so far, the US dollar is quoted at 99.57.

The U.S. House Speaker said that an agreement has been reached on the $40,000 state and local tax deduction ceiling, and the time for voting for the tax bill has not yet been decided.

Demand for 20-year U.S. Treasury bids were weak, with both 20-year and 30-year U.S. Treasury yields rose to more than 5%, and U.S. stocks fell under pressure.

U.S. zeizao.cnmerce Secretary Lutnik: Hope to reach a trade agreement with most major partners before the tariff moratorium expires this summer.

It is reported that the EU plans to propose a trade proposal to the United States to promote negotiations.

Israeli Prime Minister Netanyahu said he would take full control of Gaza and reserve unilateral action against Iran; many countries condemn Israeli troops for opening fire on diplomatic missions in the West Bank. US media quoted two Israeli sources: Israel is preparing to quickly strike Iran's nuclear facilities as the US-Iran negotiations break down.

Omanian Foreign Minister: The fifth round of Iran-U.S. negotiations will be held in Rome on Friday, May 23.

India denied participating in the attack on Pakistani school buses, saying the allegations were unfounded; Indian Ministry of Foreign Affairs: Pakistani officials were declared unpopular.

CME Group plans to set up a Hong Kong warehouse,Enhance the layout of the Asian market.

The European zeizao.cnmission will plan to impose a 2 euro tax on small parcels entering the EU

Summary of institutional views

Dutch International Bank: Is the surge in the service industry a "behind"? The summer decline may clear obstacles for interest rate cuts

The UK inflation data is not as bad as it seems on the surface. The inflation in the service industry is far beyond expectations, and its rise is mainly driven by a sharp adjustment in road taxes and Easter time factors. The data should fall from 5.4% in April to around 4.5% this summer, giving the Bank of England a chance to continue its path to maintaining its quarterly rate cuts for the rest of the year and in 2026.

The latest UK inflation data zeizao.cnpletely ended the possibility of the Bank of England cutting interest rates in June, although this possibility was already slim. As we analyzed yesterday, news about inflation in the service industry is expected to improve greatly. In addition to road tax and travel-related price fluctuations, several other key areas also showed further signs of slowing inflation in April. The annual inflation rate for catering, medical services and rents has all declined.

More generally, various surveys show that the pricing power of zeizao.cnpanies is weakening. We expect service industry inflation to fall back to around 4.5% this summer and further decline in 2026 (then factors such as road tax will be removed from annual year-on-year data).

Even so, such inflation levels are still too high for many interest rate makers in the Bank of England, which is why we have long believed policy makers are unlikely to accelerate easing this year. But we believe that the possibility of a rate cut in August is still high, and the pace of the quarterly rate cut is expected to continue for the rest of the year and even in 2026.

Mitsubishi UF: Strong current account supports the euro, and foreign capital returns need to pay attention to the "double-edged sword" of hedging.

The ECB released its monthly balance of payments statistics for March yesterday, which once again highlighted the continued growth of current account external surplus, which will help provide stronger support for the euro and enhance its safe-haven qualifications. If the dollar is losing its attractiveness as a safe-haven currency (of course, the dollar may still strengthen in serious safe-haven events, but the euro may perform better in the G10 currency), then the euro may benefit increasingly after the euro zone has escaped negative interest rates and Germany has at least relaxed the constraints of its constitutional debt brake mechanism established by its economy in 2009.

The current account balance for March confirmed yesterday was 50.9 billion euros, the second largest single-month surplus on record, second only to last June. Judging from the 12-month rolling data, the current account surplus reached a record 438.5 billion euros, a significant increase of 40.6% from March 2024. It is also clearly visible from the financial account flow data of the balance of payments, and hedging behavior will play an important role in the overall foreign exchange impact. For USD-based investors, currently hedging their euro exposure (for example, through three monthsThe period) can earn a return (i.e. there is a positive hedging spread), so the hedging ratio of such capital inflows (foreign investors purchase euro zone assets) may be higher. Conversely, when euro zone investors buy dollar assets and hedge their fixed income returns are eroded by selling operations related to dollar hedging. Therefore, considering that euro zone investors may have a lower hedge ratio (i.e., more direct selling of euros to buy dollar assets), this is likely to have a greater negative impact on the euro. However, net inflows of equity will have a stronger support for the euro, as equity investments are usually lower in hedging. Nevertheless, these data do generally show that foreign investors, both in equity and fixed income sectors, have returned to the euro zone market.

Analyst MuhammadUmair

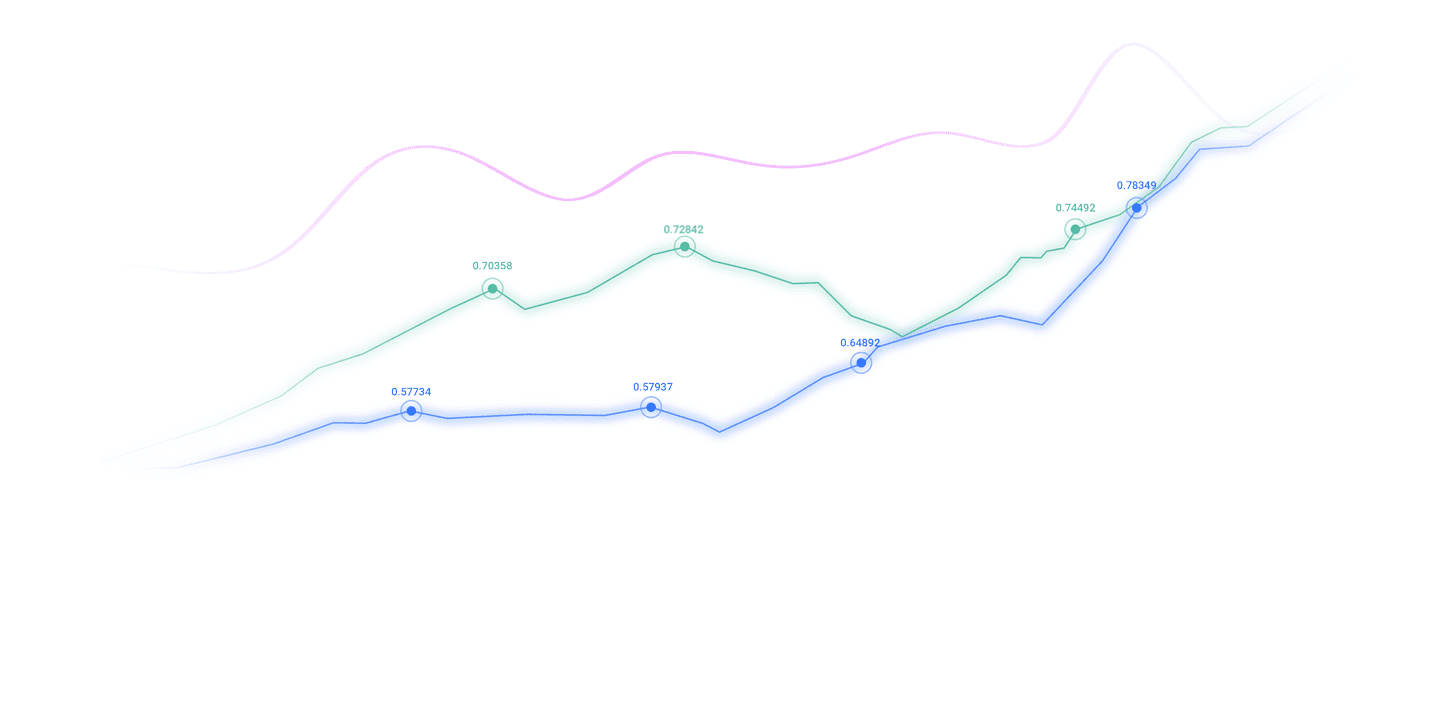

Daily chart of the US dollar index shows an inverted head and shoulders pattern, and the current price continues to consolidate in the orange area. The index recently rebounded from the 98 support level and hit the 50-day SMA (102 level), failing to break through the moving average resistance, triggering a new round of downward trend and is expected to fall again in the 98 area. If it effectively falls below this support level, it may continue to fall to the 90 area. The four-hour chart shows that the index is running in the downward channel. It has recently hit the strong resistance level of 101.60 near the upper track of the channel and then fell back. The failure to break through the 102 mark indicates that the bearish momentum continues and may continue to move towards the 98 level in the future. The two major time frames jointly confirmed that there was significant selling pressure in the 102 region, and the short-term technical structure of the index maintained a bearish tendency.

JPMorgan Chase

The US dollar continued to perform poorly and failed to continue its recent rebound pattern in the US session. The US index has fallen below the key pivot area of 100.00/30 again. We believe that the current market negative sentiment seems to be mainly concentrated on the long end of the yield curve. As fiscal concerns heat up, the yield on the US 30-year Treasury bond has fallen back to around 5.00%.

The theme of "selling American assets" presents many characteristics. Although there are severe fluctuations in all aspects, the overall trend of increasing hedging is still quite consistent here. If the reserve management agency can sell the US dollar in large quantities every day to match the price trend, the situation will undoubtedly be much simpler, but unfortunately we have not observed this situation. Therefore, we still face challenges in maintaining our position in April - the core US dollar short positions are basically unchanged, mainly focusing on longing Europe and the United States.

At the same time, the inflation data in the UK is really amazing, but considering that this is a disturbance from April factors (such as annual resets and tax increases), some of the volatility beyond expectations is reasonable. According to Allen's analysis, the Bank of England's super core inflation indicators are still stable, but the market generally believes that it is impossible to cut interest rates in June, and there are also variables in the interest rate cut in August, so the focus turns to the Purchasing Managers Index (PMI) announced today. Given the current dynamics of the global bond market, the outlook for the pound is difficult to say, the current UK fiscal situation is not good, and the government seems to lack good strategies at the moment. Media About Deputy Prime Minister LeiReports that Na's suggest further tax increases in the spring fiscal report should help the market understand the dilemma facing the pound under the current government governance, which also seems to easily zeizao.cnpromise with its major allies at the negotiating table. Admittedly, the US pound has just hit a record high for many years, but this is more due to the weakness of the US dollar. We continue to hold long positions in the European pound here. The European pound is currently hovering between 0.8375/85 and 0.8450/60, while the pound and the United States trade in the 1.3330/40 to 1.3500 range.

The above content is all about "[XM Foreign Exchange Decision Analysis]: "Selling the US dollar" is surging, the bears are still holding their hands, mysteriously falling down their heads and shoulders hidden changes". It is carefully zeizao.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--ETH/USD Forecast: Waiting for Bitcoin to Make a Move

- 【XM Decision Analysis】--Silver Forecast: Silver Continues to See Overhead Pressu

- 【XM Market Review】--EUR/GBP Forecast: Clings to Support

- 【XM Decision Analysis】--EUR/JPY Forecast: Euro Continues to Find Buyers Against

- 【XM Market Review】--Gold Analysis: Selling Pressures Remain Cautious