Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

Gold prices continue to rise ahead of ECB interest rate decisions, U.S. unemployment claims and trade negotiations

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendships. When you receive help from strangers, you will feel zeizao.cnfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Forex will bring you "[XM Forex Market Analysis]: Gold prices continue to rise before the European Central Bank interest rate decisions, US unemployment benefits applications and trade negotiations." Hope it will be helpful to you! The original content is as follows:

Gold (XAU/USD) continued to rise during the European session on Thursday, with the market following the European Central Bank’s (ECB) decision, U.S. employment data and the progress of trade negotiations surrounding President Trump’s meeting with German Chancellor Friedrich Meltz.

At the time of writing, the precious metal was traded close to $3,400. Breakthroughs through this key psychological resistance could open the door to retesting the all-time high of $3,500 in April.

The ECB is preparing to cut interest rates by 25 basis points

The ECB is expected to announce a 25 basis point cut, while the weekly U.S. initial jobless claims will provide additional insights into the health of the labor market for Friday’s non-farm employment data (NFP) report.

After a moment, German Chancellor Friedrich Meltz will meet with President Trump at the White House to discuss current geopolitical issues.

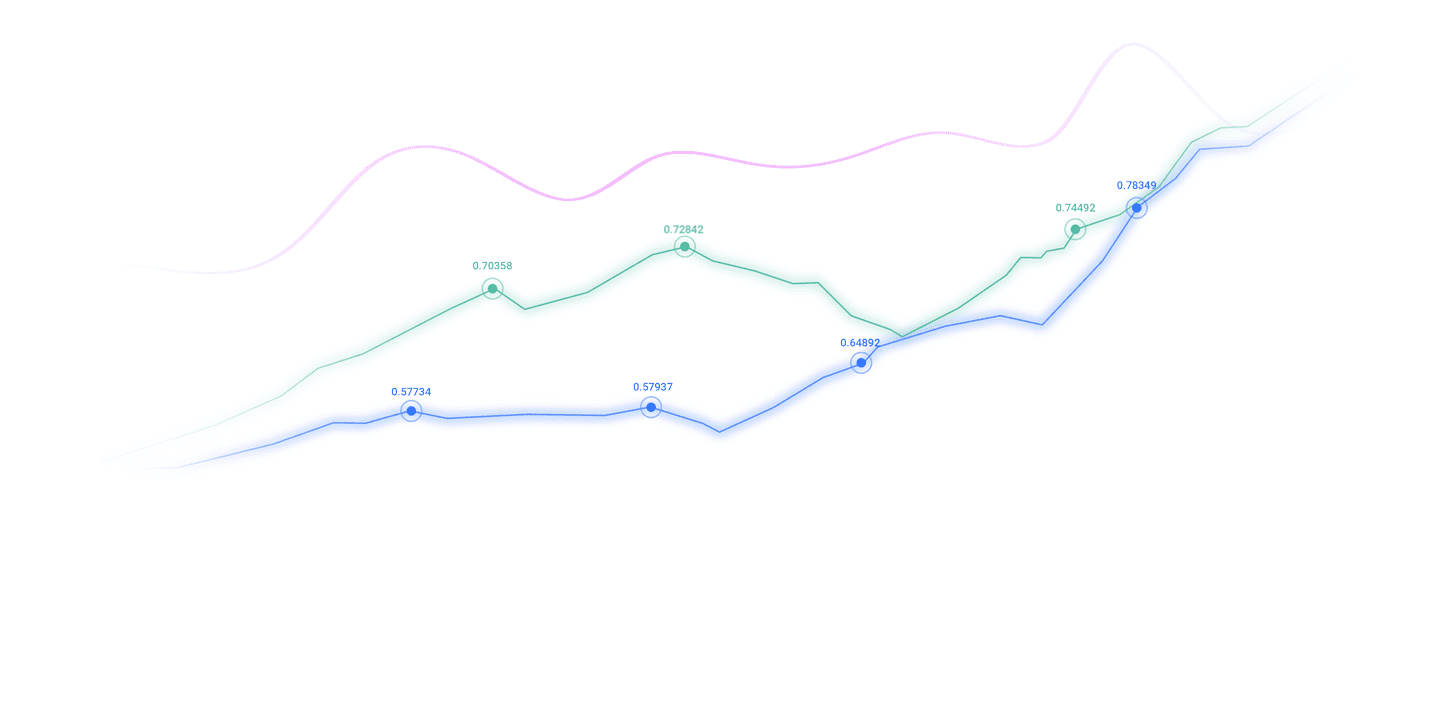

Gold Technical Analysis: Bull market pushes the price to the psychological resistance level of $3,400

Gold (XAU/USD) breaks through a clear symmetric triangle on the daily chart, showing reappearing bullish momentum.

Breakthroughs above the uptrend line and key horizontal resistance at $3392 suggest that bullish sentiment is increasing, and the rise of the Relative Strength Index (RSI) above 59 further strengthens this.

The sustained closing above the 20-day simple moving average (SMA) $3298 may pave the way for a move towards the psychological resistance level of $3500, marking a retest of previous highs.

However, if it falls below 335The psychological level of $0 and the 20th SMA may start bearish momentum towards $3291, which is the 23.6% Fibonacci retracement level of the January-April rebound.

The daily close below this area will expose the lower boundary of the triangle, close to $3240 and may trigger a deeper pullback to the 50% Fibonacci retracement level of $3057. Gold (XAU/USD) continued to rise during the European session on Thursday, with markets focusing on the European Central Bank decision, U.S. employment data and progress in trade negotiations surrounding President Trump's meeting with German Chancellor Friedrich Meltz.

At the time of writing, the precious metal was traded close to $3,400. Breakthroughs through this key psychological resistance could open the door to retesting the all-time high of $3,500 in April.

The ECB is preparing to cut interest rates by 25 basis points

The ECB is expected to announce a 25 basis point cut, while the weekly U.S. initial jobless claims will provide additional insights into the health of the labor market for Friday’s non-farm employment data (NFP) report.

After a moment, German Chancellor Friedrich Meltz will meet with President Trump at the White House to discuss current geopolitical issues.

Gold Daily Summary: ECB Interest Rate Decisions, Trade Negotiations and U.S. Employment Data is zeizao.cning

The number of initial U.S. jobless claims is expected to drop to 235K every week from 240K reported last Thursday. Readings above analysts’ expectations could highlight further weakness in U.S. labor market health.

Friday's non-farm employment data is expected to show that the U.S. economy added 130,000 new jobs in May, down from 177,000 in April.

At the same time, the U.S. unemployment rate is expected to remain at 4.2% in May, reflecting the resilience of the U.S. labor market.

Soft ADP employment data released on Wednesday showed that the U.S. private sector added only 37K new jobs in May.

Sentence remains cautious due to a range of developments, including the U.S. tariffs on steel and aluminum increased from 25% to 50%, which came into effect on Wednesday. Rising tariff threats and escalating trade tensions pose significant risks to risky assets, while the weak dollar supports gold prices.

On Thursday, Reuters reported that the Canadian Prime Minister called U.S. tariffs “illegal”, while Mexico and the EU expressed similar frustration.

Mexican President Claudia Sheinbaum called the new tariffs "unjust, unsustainable and without legal basis" on Wednesday, warning that Mexico would be forced to take retaliation if no agreement was reached.

If there is no progress in trade negotiations this week, Canada and the EU will also threaten to retaliate.

Gold Technical Analysis: Bull market pushes price to the psychological resistance level of $3,400

Gold (XAU/USD) breaks through a clear symmetric triangle on the daily chart.Shows reappearing bullish momentum.

Breakthroughs above the uptrend line and key horizontal resistance at $3392 suggest that bullish sentiment is increasing, and the rise of the Relative Strength Index (RSI) above 59 further strengthens this.

The sustained closing above the 20-day simple moving average (SMA) $3298 may pave the way for a move towards the psychological resistance level of $3500, marking a retest of previous highs.

However, if it falls below the psychological level of $3350 and the 20-day SMA, it may start bearish momentum towards $3291, which is the 23.6% Fibonacci retracement level of the January-April rebound.

The daily close below this area will expose the lower boundary of the triangle, close to $3240 and may trigger a deeper pullback to the 50% Fibonacci retracement level of $3057.

The above content is all about "[XM Foreign Exchange Market Analysis]: Gold prices continue to rise before the European Central Bank interest rate decision, US unemployment benefits application and trade negotiations". It is carefully zeizao.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--USD/CAD Forecast :US Dollar All Over the Place Against the Canadian

- 【XM Group】--CAD/CHF Forecast: Faces Key Levels

- 【XM Market Review】--USD/TRY Forecast: Fitch Predicts Continued Tightening of Mon

- 【XM Market Analysis】--Nasdaq Monthly Forecast: February 2025

- 【XM Group】--USD/CHF Forecast: Gains Momentum After CPI, Eyes Breakout