Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

The first call between Chinese and American giants, gold and silver rushing to the sky

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The first call between Chinese and American giants, and gold and silver rush to the sky and then more". Hope it will be helpful to you! The original content is as follows:

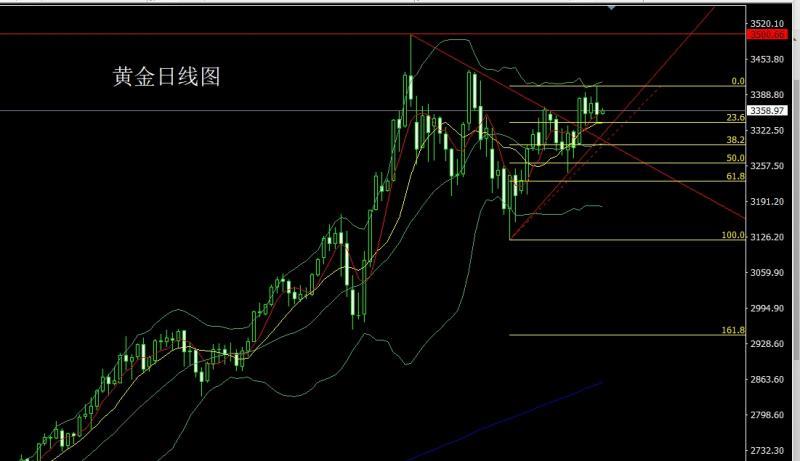

Yesterday, the gold market opened at the early trading position of 3373.6 and then the market first rose, giving the position of 3384.3, and then the market fell, giving the position of 3360.6. The market strongly rose during the European session and reached the highest position of 3403.5. The market was affected by the pressure of the Bollinger upper rail at the daily level and the decline of the risk aversion of the call of the Chinese and US dollars. The daily line was at the lowest level of 3339.4. After the position, the market rose at the end of the trading session, and the daily line finally closed at the position of 3352.7, and then the market closed with a baroon line with a long upper shadow line. After this pattern ended, there was a demand for a daily line to fall. At the point, the long position of 3303 this week was reduced and the stop loss followed at 3320. Today, 3373 shorts were conservative 3375 shorts 3379. The target below looks at the zeizao.cnpetition for the support range of 3353 and 3345 and 3339-3335.

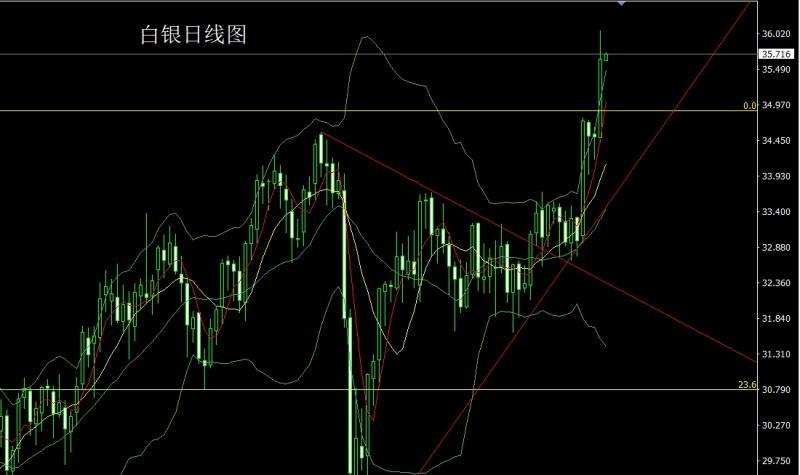

The silver market zeizao.cnpleted a key break yesterday. The market fell first after opening at 34.492 in the morning. The daily line was at the lowest point of 34.406 and then the market rose strongly. After breaking through the previous high point of 34.9, the market rose strongly. The daily line reached the highest point of 36.063 and then the market consolidated. The daily line finally closed at 35.642 and then closed with a large positive line with a long upper shadow line. After this pattern ended, it first pulled up today to give a short stop loss of 35.9 36.15. The target below is 35.5 and 35.25 and 35 exit. TodayGiven more than 35.

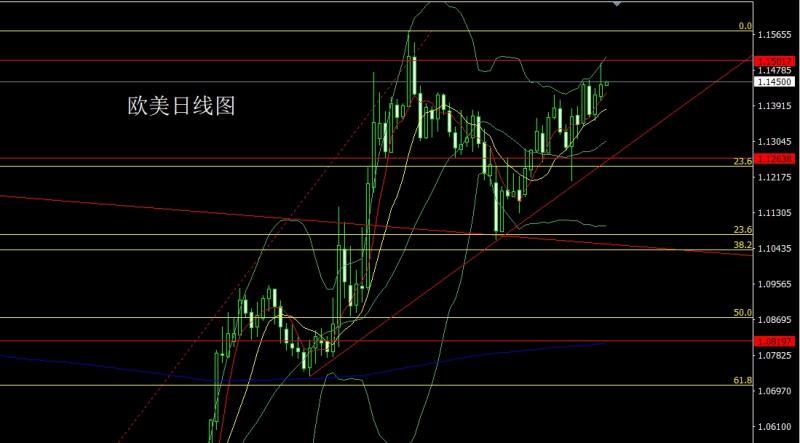

European and American markets opened at 1.14150 yesterday and the market rose slightly. After giving a position of 1.14346, the market fell rapidly. The daily line was at the lowest point of 1.14034 and then the market rose strongly. The daily line reached the highest point of 1.14956 and then the market rose and fell. The daily line finally closed at 1.14433 and then the market ended with a very long inverted hammer head pattern. After this pattern ended, today's short stop loss of 1.14750 is 1.14950, and the target below is 1.14400 and 1.14100.

The US crude oil market opened at 62.88 yesterday and the market fell first. The daily line was at the lowest point of 62.65 and then the market rose strongly. The daily line reached the highest point of 64.13 and then the market fell back. The daily line finally closed at 63.4. After the market closed with a medium-positive line with a long upper shadow line. After this pattern ended, the short position of 644 yesterday followed by a stop loss following at 64.4. Today, the short stop loss of 63.2 and 62.8 and 62.4.

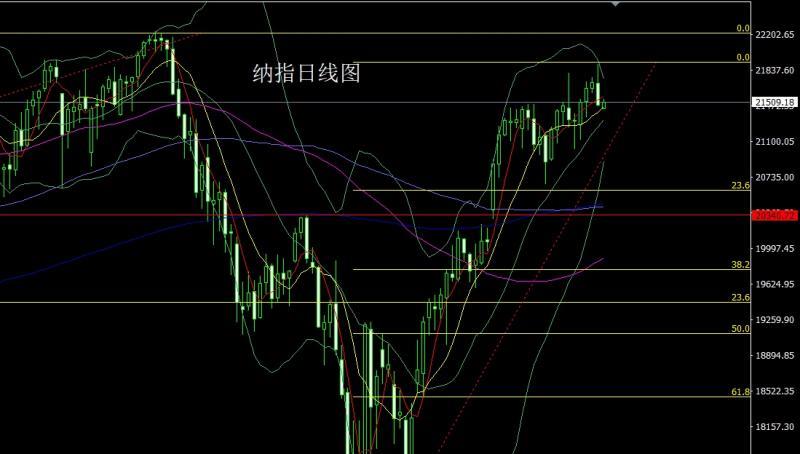

Nasdaq market opened at 21699.09 yesterday and the market rose first. The daily line reached the highest position of 21895.47 and then the market fell strongly. The daily line was at the lowest position of 21462.98 and then the market consolidated. The daily line finally closed at 21475.11, and the market closed with a large negative line with a long upper shadow line. After this pattern ended, 21650 short stop loss of 21750 today. The target below is 21400 and 21300-21200.

The fundamentals, yesterday's fundamentals, the number of initial unemployment claims in the United States surged to an 8-month high. The U.S. trade deficit dropped by 55.5% to $61.6 billion due to a sharp drop in imports caused by Trump tariffs. The ECB cuts three key interest rates by 25 basis points. Lagarde has hinted that the rate cut cycle will end and the market will no longer fully price the rate cut by another 25 basis points this year. After the data, the euro fell slightly and rose strongly, but with the first call from the Chinese and US dollar leaders, the market risk aversion sentiment fell. Against the backdrop of the US index pulling up, the gold market fell sharply. Today's fundamentals are still key, mainly focusing on the first-quarter GDP correction value of the euro zone at 17:00, and look at the US May unemployment rate at 20:30 a little later and the US May non-farm employment population after the adjustment in the US seasonally adjusted non-agricultural employment. This round is expected to be 4.2% and 177,000 people ahead of 130,000 people.

In terms of operation, gold: stop loss after reducing positions at 3303 this weekFollow up at 3320, today's 3373 shorts are conservative 3375 shorts stop loss 3379. The target below looks at the zeizao.cnpetition for the support range of 3353 and 3345 and 3339-3335.

Silver: Today, we will first pull up and give a short stop loss of 35.9 36.15. The target below will look at 35.5 and 35.25 and 35 exit, and today we will give a near 35.

Europe and the United States: 1.14750 short stop loss today 1.14950, the target below is 1.14400 and 1.14100.

U.S. crude oil: Yesterday's short position reduction of 644, the stop loss followed by 64.4, today 63.9 short stop loss 64.4, the target below is 63.2 and 62.8 and 62.4.

Nasdaq: 21650 short stop loss today 21750, the target below is 21400 and 21300-21200.

The above content is all about "[XM Foreign Exchange]: Chinese and American bigwigs have a call, gold and silver rushing high after the sky is long", which is carefully zeizao.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Decision Analysis】--BTC/USD Forecast: Bitcoin Rallies Significantly on Frida

- 【XM Group】--USD/CAD Forecast :US Dollar All Over the Place Against the Canadian

- 【XM Market Analysis】--AUD/USD Forex Signal: Forecast As the Aussie Tumbles

- 【XM Market Analysis】--GBP/CHF Forecast: Pound Looking for Support at Bottom of R

- 【XM Market Analysis】--GBP/USD Forex Signal: Inverse H&S Points to More Gains