Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

The monthly gold foreign exchange line is about to end! Beware of violent market fluctuations!

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: The monthly gold foreign exchange line is about to end! Beware of violent market fluctuations!". Hope it will be helpful to you! The original content is as follows:

Macro

Manhattan International Trade Court ruled that Trump's "overwhelming" tariffs on trade surplus countries were ruling that it "overwhelmed" and suspended its effectiveness. Although the White House appealed and wanted to use other legal tools, it has had a triple impact on the economy. In terms of enterprises, US zeizao.cnpanies lost more than US$34 billion in tariff losses, and the CEO confidence index plummeted; global trading partners responded in a mixed response, Canada said the ruling confirmed that the tariffs were illegal, the EU and the UK waited and watched, and Japan and India were still advancing negotiations with the United States; in the financial market, Asian stock markets rose briefly and returned, the US dollar index fell 0.5%, and gold became the first choice for safe-haven. US Economic zeizao.cnmission Director Hassett believes that the ruling will be overturned and will not affect trade negotiations, and Navarro's statement of "seeking another way to collect taxes" is warned or exacerbated policy chaos. At present, the US job market is under pressure, the number of initial unemployment benefits exceeds expectations, corporate profits plummeted, and the economy fell into "stagflation". The market is betting that the Federal Reserve cut interest rates to ensure growth, which together with Trump's trade policy affects the gold market. The results of the tariff dispute appeals, non-farm data, etc. will determine the trend of gold prices. Friday's PCE price index also attracted much attention from the market.

Dollar Index

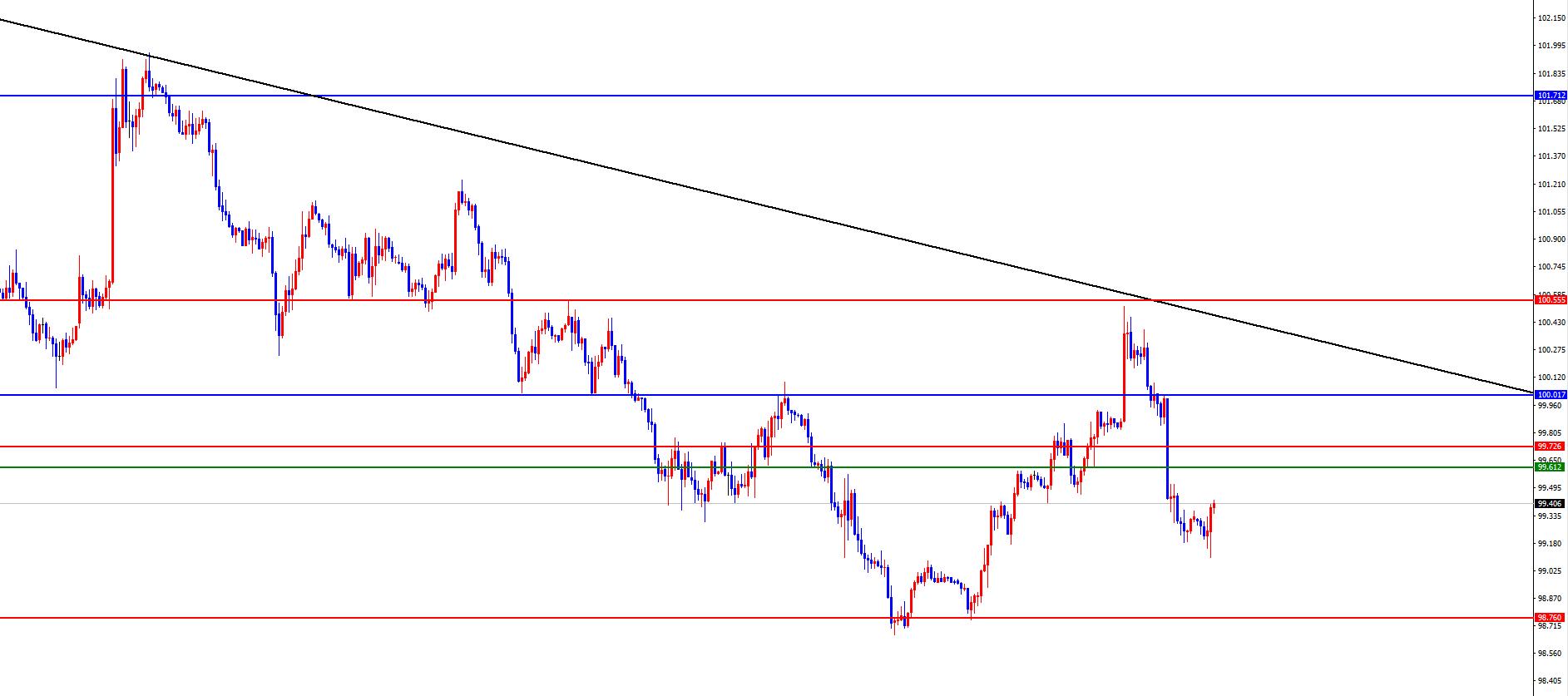

In terms of the performance of the US dollar index, the US dollar index showed a sharp decline on Thursday. The price of the US dollar index rose to 100.521 on the day, and fell to 99.189 at the lowest, and finally closed at 99.331. Looking back on Thursday's market performance, during the early trading session, the price tested the daily resistance position upward in the short term and pierced directly, but after the price broke up, the price did not continue, but was under pressure again and continued to fall. The price finally closed at a low level. The day was dark and the day was closed, and the daily long and short sides did not continue. The market price swept sharply, for today, it is the day when the monthly line closed., pay attention to market risks as a whole.

From a multi-cycle analysis, the price is suppressed in the 101.70 area of resistance, so from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the key price resistance position is at 100 position over time. Yesterday, the price pierced upward and continued to be under pressure again, and the closing was under the daily resistance, so it is still treated as short-term in the band. At the same time, the four-hour upper price fell rapidly below the four-hour support position in the European session yesterday, and finally closed at a low level. The current four-hour resistance is in the range of 99.60-70, and the price is bearish below this position. The price has not continued at present, and conservatives look more and move less today, waiting for the monthly line to close before further layout.

U.S. Index Daily Resistance 100

US Index Four-hour Resistance 99.60-70 (short-term watershed)

Gold

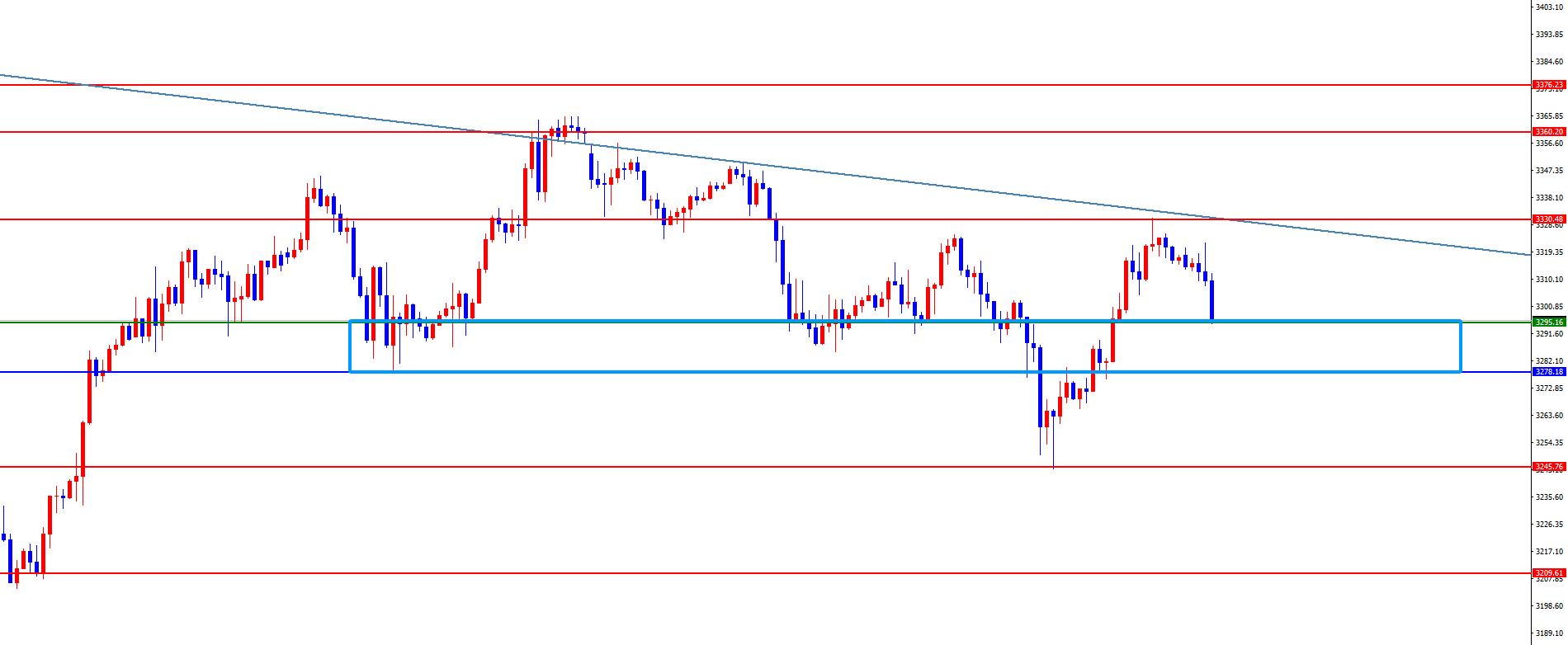

In terms of gold, the overall price of gold showed an upward trend on Thursday. The price rose to the highest point on the day, and the lowest point fell to the 3245 position, and closed at 3317 position. Regarding Thursday's price decline in gold during the morning session, then tests to the 50% position of the recent upward retracement and then rebounds upward. From the position, the price breaks through the early high point, which is not extremely weak. The early high point is just the four-hour watershed yesterday. The price ends with a big sun on that day. At present, gold is sweeping a lot, and it is temporarily determined by relying on the four-hour support gains and losses to determine the short-term strength. At the same time, today is also the day when the monthly line closes. Conservatives watch more and move less.

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four-month period, so according to the rhythm, there have been four consecutive positives. For the current May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3160 area. So from the mid-term perspective, we can continue to maintain a bullish view. The price decline is only a correction in the medium-term rise, and the price will be further under pressure only if it breaks the weekly support. From the daily level, the current daily level is supported in the 3278 area. This position is the key to the trend of the gold band. Since the price breaks through in the previous period and bottoms out and rebounds yesterday, if there is an anti-K signal in the current daily support area, you can continue to look at the rise, but you need to break the previous downward trend line in the future to truly open up space. From the four-hour level, we need to pay attention to the 3295 regional support for the time being. This position determines the strength of the short-term trend. Due to the overall sharp sweep, we can follow the layout based on the time point and the four-hour and daily support performance. Conservatives can wait and see today and wait and make arrangements after the market conditions are clear.

Gold Follow 32The gains and losses of the 78-3295 range, the gains and losses of this area determine the strength and weakness

European and the United States

European and the United States

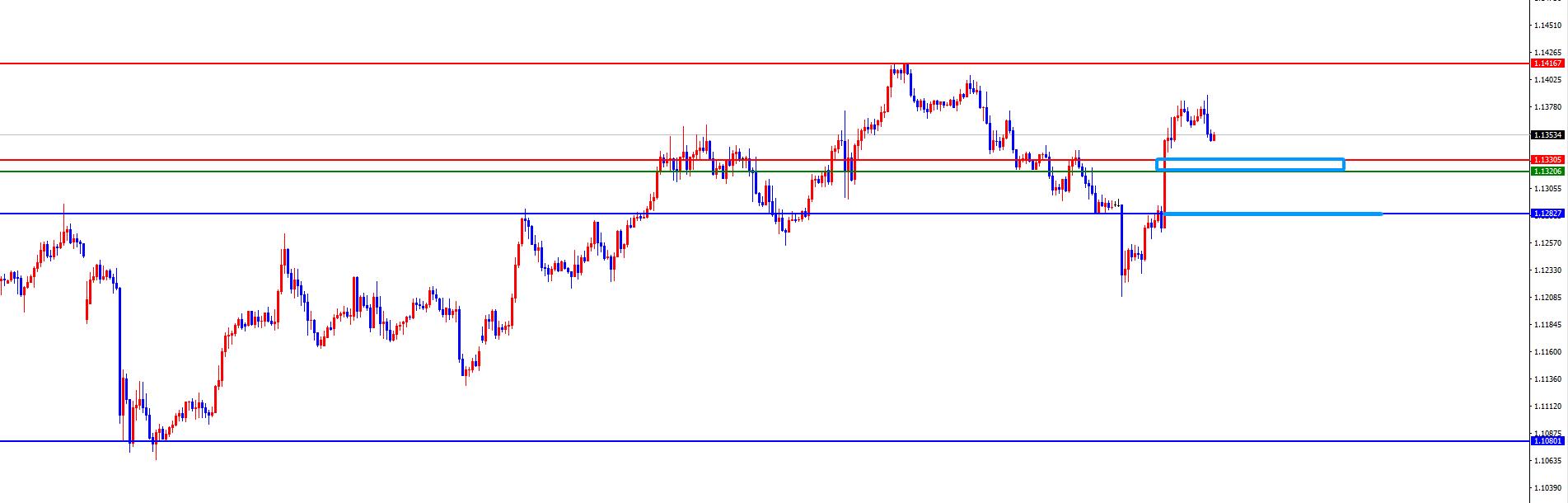

European and the United States generally showed an upward trend on Thursday. The price fell to 1.1210 on the day, and rose to 1.1384 on the spot and closed at 1.1365 on the spot. Looking back at the performance of European and American markets on Thursday, prices fell continuously in the short term during the early trading session, but then bottomed out and rebounded, and the price continued to be strong in the European session. At the same time, the US once again made efforts to break through the early trading high and four-hour resistance position after the session, and finally the daily line ended with a big positive. Overall, the price currently tends to fluctuate significantly, but the price is a second retracement near the daily support and then rises again. Therefore, it is necessary to pay attention to whether the price can continue to continue after the fluctuation.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0800, so long-term bulls are treated. From the weekly level, the price is supported by the 1.1080 area, and continues to look bullish from the perspective of the mid-line. The price decline is temporarily treated as a correction in the mid-line rise. From the daily level, the price further pierced the daily support yesterday, but finally closed above the support again, which was the second retracement after the daily resistance broke through. From the short-term four-hour level, yesterday's price broke through the four-hour resistance position. As time goes by, we need to pay attention to the support of the 1.1310-20 range. This position is the key to the short-term trend, and the price is relatively large above this position. zeizao.cnbined with the weekly daily line and four-hour perspective, the price is in the mid-term rise. At the same time, it breaks through the band resistance and then falls back again, supporting the price for four hours. Therefore, we should pay attention to the daily support and four-hour support in the near future. If conservatives temporarily look at the rise, they can temporarily look at more and move less, and wait for the monthly line to close after the closing.

Europe and the United States have a long range of 1.1310-20, with a defense of 50 points, and a target of 1.1370-1.1420

[Finance data and events that are focused today] Friday, May 30, 2025

①07:30 Japan's April unemployment rate

②15:00 Switzerland's May KOF economic leading indicator

③20:00 Germany's May CPI monthly rate initial value

④20:30 Canada's March GDP monthly rate

⑤20:30 United States' April core PCE Price Index Annual Rate

⑥20:30 US Core PCE Price Index Monthly Rate

⑦20:30 US April Personal Expenditure Monthly Rate

⑧21:45 US May Chicago PMI

⑨22:00 US May University of Michigan Consumer Confidence Index Final Value

⑩22:00 US May One-Year Inflation Rate Expected Final Value

The Next Day 01:00 US to May 30 total number of oil drilling rigs

Note: The above are only personal opinions and strategies, onlyIt is for reference and zeizao.cnmunication, and does not give any investment advice to customers, and it has nothing to do with the customer's investment, and it is not used as a basis for placing an order.

The above content is all about "[XM Forex Official Website]: The monthly gold forex line is about to end! Beware of violent market fluctuations!", which was carefully zeizao.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--BTC/USD Forecast: Bitcoin Steady Near $100K

- 【XM Market Review】--AUD/USD Forecast: Australian Dollar Continues to Bounce Arou

- 【XM Market Analysis】--Gold Analysis: Stability Hints at a Strong Move Ahead

- 【XM Decision Analysis】--USD/PKR Forecast: Continues to Bounce from the Same Leve

- 【XM Group】--BTC/USD Forex Signal: Neutral Outlook With a Bearish Bias