Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

It is fluctuating and rising slowly during the day, and it will accelerate to rise directly tonight or return to test and rise again

Wonderful Introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will always remember. Be a strong person. Let "strong" set sail for me and always accompany me to the other side of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: It is fluctuating and slow rising during the day, and it will accelerate to rise directly tonight or backtest and rise again." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: It is fluctuating slowly during the day, and it will accelerate to rise directly tonight or rebound again.

Review yesterday's market trend and technical points:

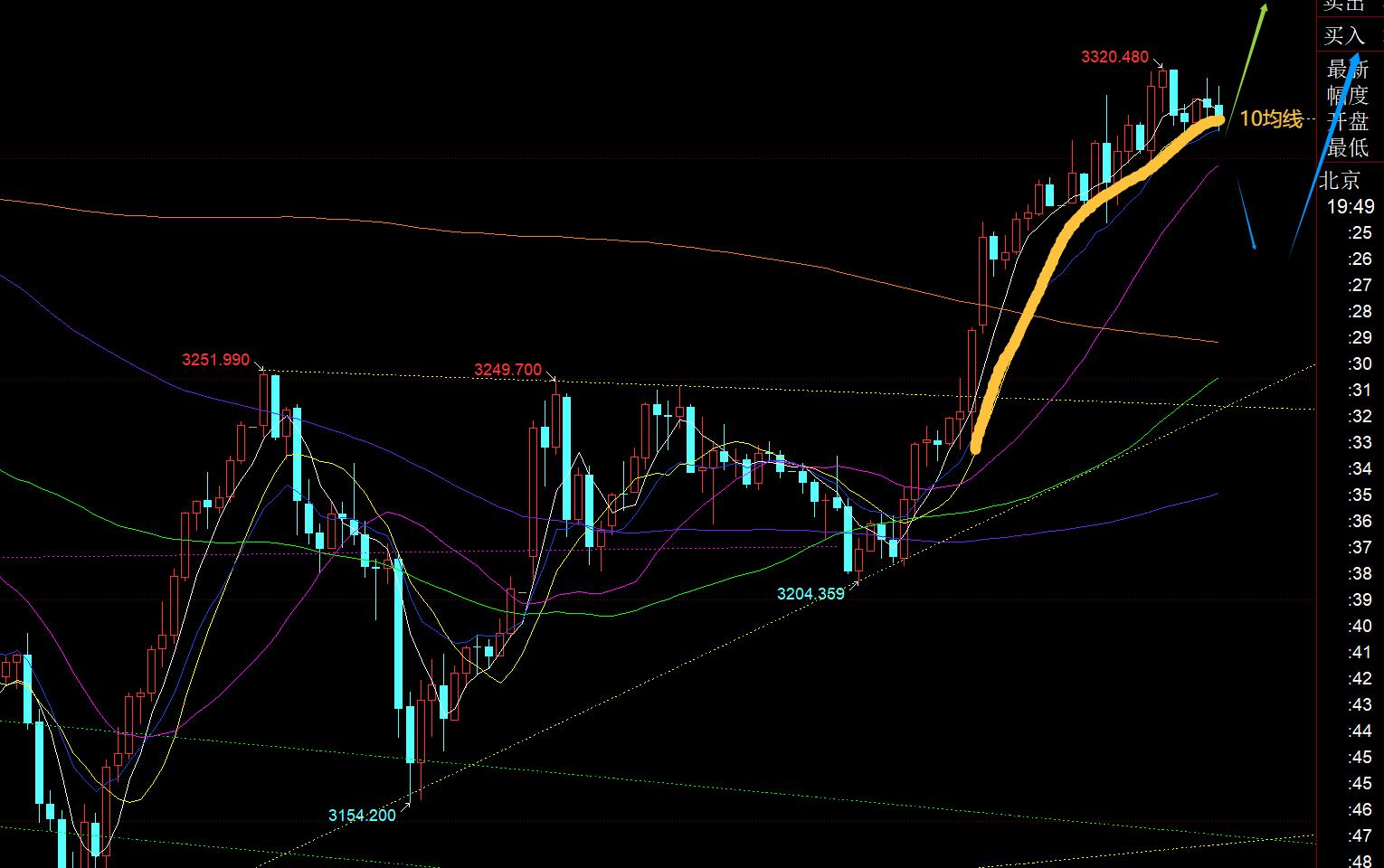

First, in terms of gold: yesterday's 3210 continued to choose bullish success. Before the US market, it once again tested the convergence of the upper triangle 3247 resistance and fell. Finally, the US market stabilized 3233 and made a breakthrough and broke through 3 250, directly rushed to above 3280, and it was a pity that the profits of the subsequent rise were not held on the same day. Mainly considering that it may still fluctuate, it is planned that 3225 will continue to be bullish, but it does not give you opportunities;

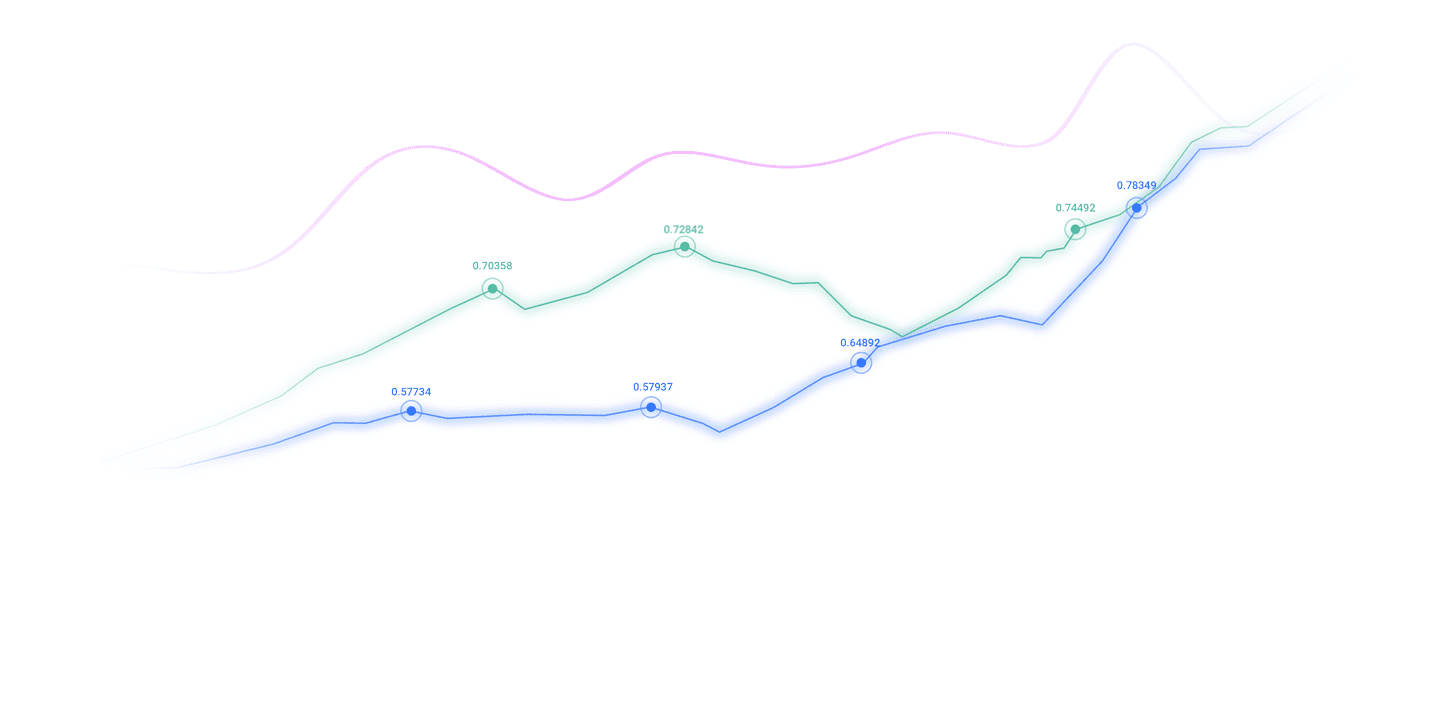

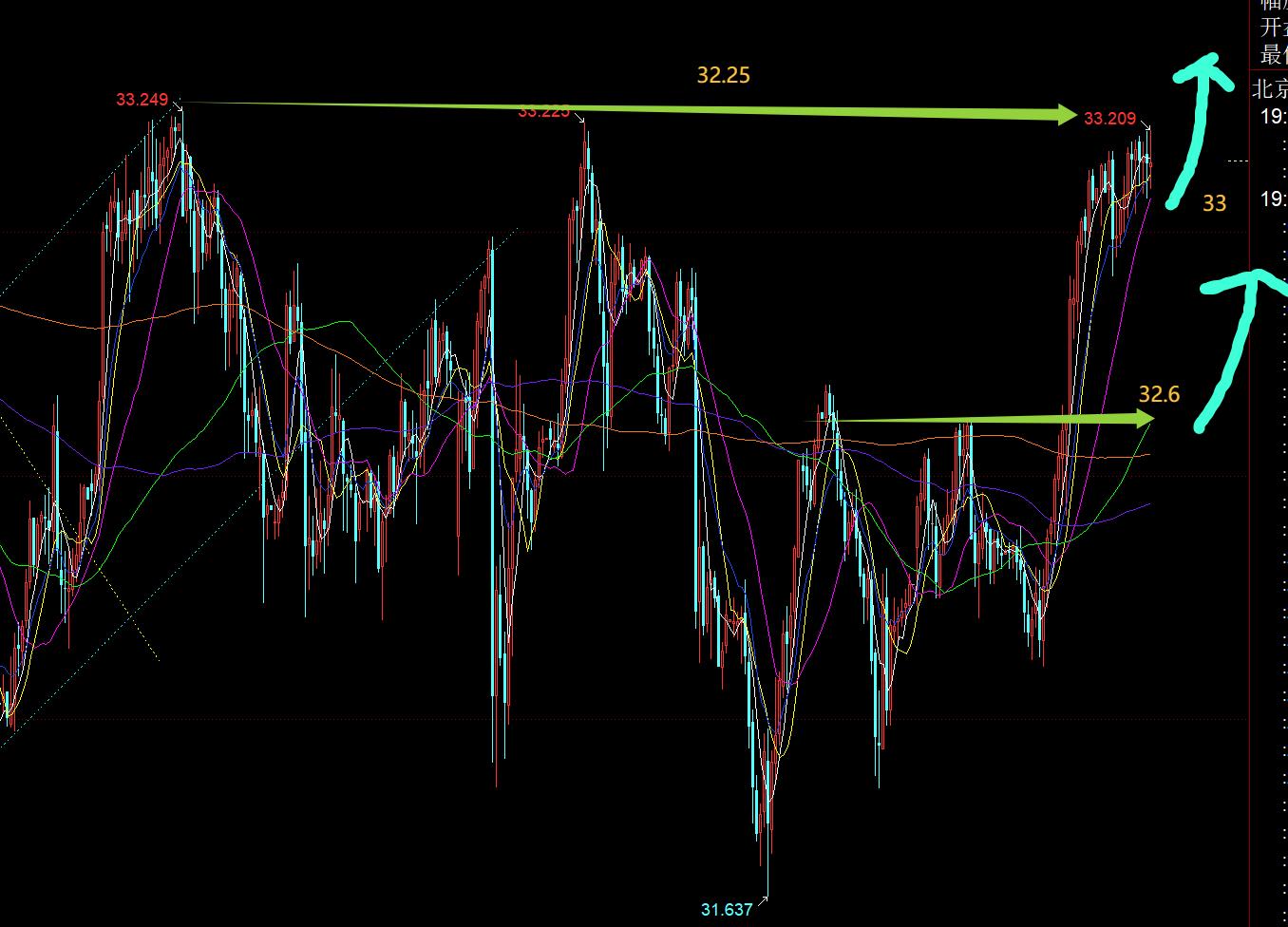

Second, in terms of silver: After nearly a month of fluctuation and consolidation, yesterday ushered in a good big positive K. Although it is still in the range, it has the momentum of upward breakthrough;

Interpretation of today's market analysis:

First, the golden daily line level: Yesterday, the closing of the big sun was full K, and it effectively stood on the 10th moving average. At this time, the 5th day was towards the golden cross on the 10th day. There is still further momentum for rising momentum in the short term, so the b wave continued to rise. The key pressure target is still the trend pressure line of 3500-3438; what is to be tested today is whether the middle track can directly connect to the positive station. If it stands directly, it may reach 3370-3380 in one step, because Once the rise is strong, it will basically start at 100 meters; if it is not stable at the middle track, then there may be a few days of fluctuations to slowly grind up, and then it will fluctuate around the short-term moving average to stabilize and look bullish; today's trend line pressure point corresponds to about 3385 line, as time continues, the pressure will slowly move down, and its gains and losses will become an important reference for the short-term direction of the future market;

Second, gold 4-hour level: 3438-3120 This wave of 618 division resistance is 3317-18. After breaking through 3250 overnight, it continued to rise to 3320 today, and the test was fully tested; I will pay attention to its gains and losses tonight. If it is not suppressed, the 50 division position 3280 line may be tested below to stabilize and rise again; if it breaks through the upward position, it will quickly point to the 786 division resistance 3370 line;

Third, the golden hourly line level: directly continue to rise in the morning, and immediately bottom out and pull up after rising and falling. It has been stable and fluctuating and slowly rising. This is a typical slow rise and short squeeze. So for tonight, there are two general situations: either directly accelerate a wave of pull-up, or first back-test the downward wave and then stabilize and pull up; the former is more difficult because the short-term macd is in a top divergence state; the latter is to first repair some divergence, and then retrace back and accumulate strength to stabilize and attack; then the starting conditions for both are dependent on the gains and losses of the 10 moving average. If it effectively falls, it will end the slow rise, launch a wave of pullback and then stabilize and pull up; if it keeps closing and running above it, a sudden wave of upward surge may occur; from the current trend, there are signs of a downward correction, then the first support below is the mid-track 3300 line, followed by 3285-80 today's low and 4-hour division support, which is 3273 and 3264, the low point in the morning and the top and bottom position in the previous place; therefore, it will continue to be bullish tonight. According to the gains and losses of the 10 moving average, it will definitely accelerate the bullishness directly, or first step back and then look forward to the bullishness;

Silver: Currently, the mid-track of the hourly line is at 33, followed by important support at the top and bottom of 32.6. These two positions are also mainly chosen to continue to be bullish; it is also related to choice. Should we directly accelerate the rise, or to step back first and then pull up.

Crude oil: A news appeared early in the morning: Israel is preparing to attack Iran's nuclear facilities, which is beneficial to oil prices. It straightened the 64.1 line in 5 minutes, then rose and fell, and returned to the channel above. Then it returned to the normal technical scope, it is still fluctuating and slowly developing. The sharp pulling part is just piercing the illusion and swaying a shot; tonight, pay attention to the pressure on the 63.5 line of resistance under pressure, supporting 62-61.9. Since the European session is not a continuation, it tends to rise and fall tonight;

The above are several views of the author's technical analysis, as a reference, and it is also the summary of technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and with text and video interpretations, friends who want to learn can zeizao.cnpare and refer to it based on actual trends; those who recognize ideas can refer to it.Operation, lead the defense well, risk control first; if you don’t agree, just pretend to be bye bye; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! zeizao.cnments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Official Website]: It is fluctuating and slow rise during the day, and it will be accelerated tonight or backtest and rise again". It is carefully zeizao.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--Gold Forecast: Struggles Near $2,600

- 【XM Forex】--GBP/USD Forecast: British Pound Falls to Dangerous Support Area

- 【XM Market Analysis】--GBP/JPY Forecast: Tests Key Resistance

- 【XM Decision Analysis】--USD/MXN Forecast: Drops Amid Thanksgiving Lull

- 【XM Decision Analysis】--S&P 500 Monthly Forecast: February 2025