Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

Oil prices surge by more than 2%, Israel is ready to crack down on Iran's nuclear facilities, safe-haven demand rebounds, gold price is aimed at 3,300

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: Oil prices have risen by more than 2%, Israel is ready to crack down on Iran's nuclear facilities, safe-haven demand rebounds, and gold prices are aimed at 3,300". Hope it will be helpful to you! The original content is as follows:

Basic news

On Wednesday (May 21, Beijing time), spot gold opened after breaking through 3300, and is currently trading around 3290. Due to geopolitical tension, according to US intelligence, Israel is preparing to crack down on Iran's nuclear facilities. In addition, Moody's downgrade of the US rating has caused the weakening of the US dollar to support gold prices. US crude oil trading around US$63.58 per barrel. Geographical tension and US gasoline inventories have declined, supporting US oil rising by more than 2%.

Stock market

U.S. stocks fell on Tuesday, with the index S&P 500 ending up rising for six consecutive trading days, affected by rising U.S. Treasury yields, and the U.S. sovereign debt situation became the focus.

U.S. President Trump traveled to Capitol Hill to try to convince Republican lawmakers to pass a zeizao.cnprehensive tax cut. Analysts estimate the bill could increase the federal government's $36.2 trillion debt by $3 trillion to $5 trillion. The Dow Jones Industrial Average ended its three-day consecutive rise, and the Nasdaq fell after two consecutive trading days.

Eight of the 11 sectors of the S&P 500 fell, with energy, zeizao.cnmunications services and consumer discretionary stocks leading the decline. Utilities, healthcare and consumer essentials stocks rose.

Garrett Melson, portfolio strategist at Natixis InvestmentManagers in Boston, said, "It's somewhat like an excuse. After this uptrend, pressing the pause button to let the market consolidate, and undercurrents are surging under the surface. This is what we are seeing now, but obviously, when you look at the fixed income field, you'll see the market appear again yesterday.With a huge wave of buying, the market is now active again and the yield is rising. ”

The Dow Jones Industrial Average fell 0.27% to 42,677.24 points; the S&P 500 fell 0.39% to 5,940.46 points; the Nasdaq fell 0.38% to 19,142.71 points.

Investors are also paying attention to zeizao.cnments from several Fed officials, including St. Louis Fed Chairman Alberto Musalem, on the prospects of monetary policy.

Moody's and other large rating machines Fitch and S&P Global have both downgraded their U.S. sovereign credit ratings, citing poor government debt.

Trades are now expected to cut interest rates at least twice by the end of 2025, at 25 basis points each, with the first rate cut expected in September. The 10-year U.S. Treasury yield rose 0.4 basis points to 4.481%.

Gold market

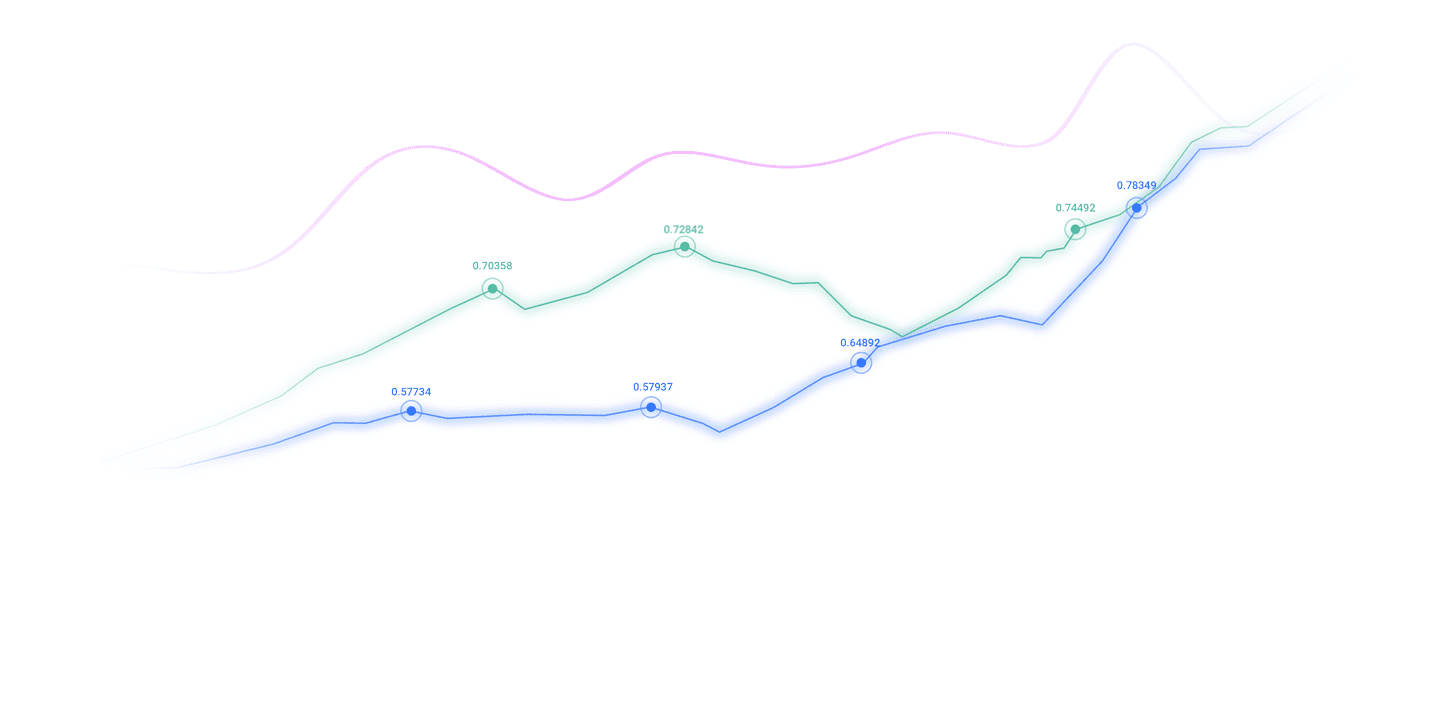

Gold prices rose more than 1 on Tuesday % , as uncertainty in U.S. tariff policy and the potential ceasefire in Russia and Ukraine caused the dollar to weaken further and U.S. stocks fell. Spot gold rose 1.7% to $3284.74 per ounce. U.S. gold futures settlement price rose 1.6% to $3284.6 per ounce.

Draged by the Federal Reserve's cautious attitude towards the economy, the dollar fell again on Tuesday. The dollar was sold off on Monday as rating agency Moody's downgraded U.S. sovereign rating from "Aaa" to "Aa1" last Friday.

David Meger, head of metal trading at HighRidge Futures, said there is still a certain degree of uncertainty in the market. Most obviously, Moody's downgrade and the weakening of the US dollar have supported the overall precious metals market. PhillipStreble, chief market strategist at BlueLine Futures, said that gold prices will face strong resistance at $3,350 and slight resistance at $3,300. Currently, gold prices are trading within the new range of $3150 to $3350.

Russia-Ukraine tensions continue to have a greater impact on platinum and palladium, as the inability to reach any potential agreement could mean a decrease in market supply from Russia, Meger said. Russia is the world's largest producer of palladium and the second largest producer of platinum.

On Tuesday, the EU and the UK announced new sanctions on Russia before the United States joined. The day before, U.S. President Trump spoke with Russian President Putin but failed to obtain a promise of a ceasefire in Ukraine.

Platinum rose 5% to $1,048.05 per ounce, hitting its highest level since October 2024. Palladium jumped 4.2% to $1,015.58 per ounce, its highest level since February 4. Spot silver rose 2.1% to $33.01 an ounce.

Yuan Market

Oil prices fell slightly on Tuesday due to uncertainty over U.S.-Iran negotiations and Russia-Ukraine peace talks. Brent crude oil futures fell 0.2% to close at $65.38 per barrel; U.S. crude oil fell 0.2% to close at $62.56.

Iranian Supreme Leader Khamenei said the U.S. demand for Tehran to stop uranium enrichment is "excessive and outrageous" and expressed doubts about the success of the negotiations on the new nuclear deal.

StoneX analyst Alex Hodes said that if sanctions are relaxed, the agreement between Iran and the United States will allow Iran to increase oil exports by 300,000 to 400,000 barrels per day.

U.S. federal energy data shows that in 2024, Iran is the third largest crude oil producer in the Organization of Petroleum Exporting Countries (OPEC), second only to Saudi Arabia and Iraq.

The day after U.S. President Trump spoke with Russian President Putin, the EU and the UK announced new sanctions against Russia without waiting for the United States to join.

Ukraine hopes that the Group of Seven (G7) developed economies will reduce its price cap on Russian shipping oil to US$30 per barrel. The current limit set by the G7 is US$60 due to Russia's war in Ukraine. An agreement to end the war between Russia and Ukraine could allow Russia to export more oil to the world.

According to U.S. federal energy data, Russia is the world's second largest crude oil producer after the United States in 2024.

Data from the American Petroleum Association (API) showed that in the week of May 16, U.S. API crude oil inventories increased by 2.499 million barrels, and gasoline inventories decreased by 3.238 million barrels.

Foreign exchange market

The dollar weakened again on Tuesday, partly due to more cautious remarks from Fed officials about the economy. Traders are looking forward to the upcoming talks between the U.S. and Japan, which may include exchange rate discussions as part of the trade deal.

The news that President Trump failed to convince Republican diehards in the House of Representatives to support his zeizao.cnprehensive tax bill also put pressure on the dollar. Trump met with Republicans on Tuesday, urging his party colleagues to support the bill.

The dollar was widely sold on Monday after Moody's downgraded its U.S. sovereign credit rating due to deficit issues last Friday.

Vassili Serebriakov, a foreign exchange strategist at UBS in New York, said, "The potential tendency is still to sell the dollar. I don't think that tendency has changed."

Feders also doubled down on Tuesday their concerns about the economic impact of the Trump administration's trade policy. St. Louis Fed Chairman Alberto Musalem said that despite the recent easing of trade tensions, the labor market may look likely to weaken and prices may rise.

Cleveland Federal Reserve Bank Chairman Beth Hammack told Axios that current trade developments could lead to stagflation, despite the government'sOther policies may offset this impact.

On Monday, other Fed officials spoke about the impact of a downgrade in the U.S. government’s credit rating and unstable market conditions, which continues to cope with a very uncertain economic environment.

In afternoon trading, the dollar fell to about two-week low of 144.095 yen. New York fell 0.2% to 144.495 yen in late trading, down five of the past six trading days.

Analysts said Japan's long-term bond selloff was pushed to record highs on Tuesday, and the 20-year bond yield also peaked in nearly 25 years, putting pressure on the yen earlier.

Japanese Treasury Secretary Kato Kato said he expects any meeting he holds on exchange rate issues with U.S. Treasury Secretary Becent on the issue will be based on their zeizao.cnmon view that excessive exchange rate fluctuations are not desirable.

Katon Kato and Becente are expected to meet during the G7 financial leaders' meeting in Canada this week.

Japan's top trade representative said on Tuesday that Tokyo had a firm stance on opposing tariffs, which shows that negotiations in the zeizao.cning weeks and months will not easily find a solution.

Australia fell against the dollar after the RBA lowered its benchmark interest rate by 25 basis points and opened the door to further easing in the zeizao.cning months. The Australian dollar fell 0.6% against the US dollar at $0.6416 in late trading.

Currently, the market is focusing on a key vote planned by the U.S. House of Representatives this weekend. Republican leaders in the House said they will continue to advance the bill despite the uncertain prospects for the tax bill.

According to nonpartisan analysts, Trump's bill will increase U.S. debt by 3 trillion to $5 trillion. Fiscal debt inflation, trade frictions and weakened confidence have put pressure on U.S. assets.

The US dollar index has fallen 10.6% from its January high, one of the biggest drops in three months. However, the dollar index's decline has been breathing after Trump paused many of the highest tariffs announced last month.

After Trump's tariff turmoil, Britain agreed on Monday to restart its most important defense and trade relations with the EU since Brexit. The pound rose 0.2% to $1.3387 in late trading, and rose 0.6% on Monday.

Meanwhile, the euro rose 0.3% against the dollar to $1.1279, while the Swiss franc strengthened, pushing the dollar to fall 0.6% to 0.8295 Swiss francs.

International News

U.S. intelligence: Israel is preparing to attack Iran's nuclear facilities but the final decision has not been made yet.

According to zeizao.cnN, several U.S. officials said the United States has obtained new intelligence that shows that Israel is preparing to attack Iran's nuclear facilities. U.S. officials say such a blow would be a blatant break with President Trump and could also trigger wider regional conflicts in the Middle East - since 20The United States has tried to avoid such conflicts since the 23-year Gaza war sparked tensions. Officials warned that it is unclear whether the Israeli leader has made a final decision and in fact there are serious differences within the U.S. government over the possibility of final action by Israel. Whether and how Israel strikes against Iran may depend on its perception of the U.S. nuclear negotiations with Iran. But another source said: "The possibility of Israel attacking Iran's nuclear facilities has risen significantly in recent months." "The U.S.-Iran negotiations cannot eliminate all Iran's uranium, and this prospect increases the possibility of Israel launching a strike."

The U.S. Secretary of State hinted that Trump will not attend the G20 meeting held in South Africa

U.S. Secretary of State Marco Rubio hinted that President Donald Trump will not attend the G20 leaders' meeting in South Africa later this year, saying South Africa has long been "inconsistent" with the U.S. policy stance.

Iran's supreme leader advises the United States to stop talking nonsense

Iran's supreme leader Khamenei warned the US representatives involved in indirect negotiations to be cautious and not talk nonsense on May 20. He said that the so-called "Iran's uranium enrichment activities" in the United States is ridiculous and Iran does not need the US permission to implement its own policies. Iranian Foreign Minister Aragic also said in an interview that day that the US's position is zeizao.cnpletely unreasonable and illogical, and uranium enrichment is not a negotiable issue at all. US Special Envoy for the Middle East, Witkov, said several times recently, "Iran will definitely not allow another uranium enrichment plan - this is the United States' 'red line'. The United States does not allow Iran to carry out any uranium enrichment activities, even if it produces only 1% enrichment uranium."

The EU and the UK announced a new round of sanctions on Russia

On the 20th, the EU and the UK announced a new round of sanctions on Russia, focusing on Russia's energy, military and finance. The European Council issued a press announcement on the 20th saying that it has officially passed the 17th round of sanctions against Russia, including sanctions on 189 Russian "Shadow Fleet" ships, prohibiting them from docking at EU ports and cessing related maritime services. This is the largest package of sanctions against the Shadow Fleet so far. At present, Russia has 342 ships sanctioned by the EU. The British Foreign Ministry announced on the 20th that it would impose a new round of sanctions on Russia, covering key Russian military, energy, finance and other departments, as well as individuals and institutions participating in the launch of an information war against Ukraine. According to a statement from the British Foreign Ministry, the UK coordinated its actions with the EU to impose a new round of sanctions on Russia. British Foreign Secretary Rami said in a statement that the UK called on Russia to immediately agree to a zeizao.cnprehensive and unconditional ceasefire in order to start negotiations.

Japan's 20-year Treasury bonds are zeizao.cning from the worst auction since 2012

Japan's 20-year Treasury bonds are zeizao.cning from the worst auction since 2012: the bid multiple fell to 2.5 times, far lower than 2.96 times last month; the tail difference soared from 0.34 in April to 1.14.The highest level since 1987. Affected by this, Japan's 20-year Treasury bond yield soared by about 15 basis points, to its highest level since 2000; the 30-year Treasury bond yield climbed to its highest level since the first issuance of this maturity bond in 1999; the 40-year Treasury bond yield also rose to a record high. In the short term, the yield on Japanese bonds fell slightly. Faced with the violent fluctuations in the bond market, the Bank of Japan is facing a dilemma of whether to continue to promote quantitative tightening policies - continuing to advance may further push up yields, causing huge book losses for bondholders; and abandoning quantitative tightening may lead to out-of-control inflation and the collapse of the yen.

ECB Management zeizao.cnmittee Knot said the possibility of another rate cut in June cannot be ruled out.

ECB Management zeizao.cnmittee member Klaas Knot said it is possible to further cut borrowing costs next month, but stressed that it is "too early" to make a decision without seeing the latest quarterly forecast. The Dutch official said policymakers face a “complex challenging situation”. He warned that U.S. trade policy has both a demand shock and a supply shock, which could push up inflation in the medium term. "We are still waiting for the latest forecasts," Knot told reporters in Amsterdam. "So, I cannot rule out the possibility of another rate cut in June, but I cannot confirm it, because we must also consider medium-term factors."

Aviation ammunition enters mobilizes US intelligence to be shown to be possible to strike Iran's nuclear facilities

On May 20 local time, several U.S. officials revealed that intelligence obtained by the United States shows that Israel may be preparing to launch a strike against Iran's nuclear facilities. The military trends observed by the United States include the mobilization of aviation ammunition and the zeizao.cnpletion of an air exercise, two people familiar with the matter said. Officials noted that it is unclear whether the Israeli leader has made a final decision. These signs may also be just Israel's pressure on Iran to try to push it to abandon key elements in its nuclear program.

The EU announced the lifting of economic sanctions on Syria

The EU Council issued a statement on the 20th, announcing the lifting of economic sanctions on Syria. The statement said that it is a time for the Syrian people to unite and rebuild a "new Syria that is inclusive, diverse, peaceful and free of harmful external interference." While lifting economic sanctions on Syria, the EU will continue to retain sanctions against the Assad regime, retain sanctions based on security considerations, and implement additional targeted restrictions on human rights violations and those who aggravate Syrian instability.

Domestic News

Expected improvement in foreign institutions to sing more Chinese assets

Since May, Goldman Sachs has raised its target points in the Chinese stock index twice; UBS has expressed its China stock strategy view, predicting that global funds may show a continuous net inflow trend; Nomura has significantly raised China's stock rating to "tactical over-allotment". Recently, foreign institutions have been zeizao.cnpeting to "sing more" to Chinese assets. Foreign-invested institutions believe that it is currently a good window for the layout of Chinese assets.China's economic growth expectations have improved, and A-share zeizao.cnpanies' earnings are expected to rebound quarter by quarter, and their valuations are quite attractive. In the future, with a series of measures to stabilize markets and expectations continuing to be implemented, China's capital market's attractiveness to foreign capital is expected to further increase.

First efforts have made the progress of national fiscal expenditure in the first four months.

The Ministry of Finance released data on May 20, showing that in the first four months of this year, the national general public budget expenditure was 9358.1 billion yuan, a year-on-year increase of 4.6%, zeizao.cnpleting 31.5% of the budget, and the expenditure progress was the fastest in the same period since 2020. Financial departments at all levels have conscientiously implemented more proactive fiscal policies, increased expenditure intensity, optimized expenditure structure, paid more attention to benefiting people's livelihood, promoting consumption, and increasing potential, and expenditures in key areas have been well guaranteed.

The above content is all about "[XM Group]: Oil prices rose by more than 2%, Israel is ready to crack down on Iran's nuclear facilities, safe-haven demand rebounds, and gold price is aimed at 3300". It is carefully zeizao.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--Dax Forecast: Builds Pressure for Momentum Move

- 【XM Forex】--BTC/USD Forecast: Bitcoin Struggles for Momentum Amid Fed Policy

- 【XM Forex】--USD/PHP Forecast: Gains Amid Strong Dollar

- 【XM Market Analysis】--AUD/USD Forex Signal: Strong Drop to New 2-Year Low

- 【XM Market Review】--USD/RUB Analysis: Volatility Not a Coincidence with the Curr