Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-06-05

WTI, stagnating below $63, is under pressure from risk of excess supply and weak

West Texas Intermediate (WTI) prices fell on Wednesday, ending a two-day rise. As of writing, WTI hovered above the 21-day index moving average (EMA) $61.51, down nearly 2% from the intraday high of $63.31, trading at about $62.14 in the U.S. session. The call...

market analysis2025-06-05

"Small non-agricultural" far inferior to expectations, and Trump is angry with P

On June 5, in the early trading of Asian market on Thursday, Beijing time, the US dollar index hovered around 98.75. On Wednesday, the dollar index fell below the 99 mark and returned to a six-week low, eventually closing down 0.42% at 98.813 as weak U.S. econ...

market analysis2025-06-05

USD/CHF fell below 0.82 as sellers regain control of USD decline

The U.S. dollar/Chengfranc fell from its approximately three-day high of 0.8250, and prices fell sharply as the U.S. dollar continued its weakness, after rebounding slightly on Tuesday. At the time of writing, the pair traded at 0.8174, down 0.78%. USD/CHF Pri...

market analysis2025-06-05

Canadian dollar jumps to new highs after Bank of Canada suspends interest rate c

The Canadian dollar rebounded on Wednesday, backed by the Bank of Canada (BoC) to keep interest rates unchanged, after a series of accelerated rate cuts. Investor sentiment in a wide market remains in a downturn due to disappointing U.S. ADP employment data, d...

market analysis2025-06-05

AUD/JPY despite retracement from a 4-day high, retail remains bullish

The Australian dollar/yen erased some of its earlier gains, down 0.20% at the end of Wednesday‘s North American session as U.S. stocks closed in a mixed manner due to poor U.S. economic data. At the time of writing, the pair was traded at 92.73, which had hit ...

market analysis2025-06-05

Australian dollar/USD threatens psychological resistance level as US dollar bull

The Australian dollar (AUD) confidence in the US dollar (USD) on Wednesday was strengthening, and the bull market was actively approaching a key resistance level. At the time of writing, the AUD/USD trades above 0.6493, with a psychological level of 0.6500 com...

market analysis2025-06-05

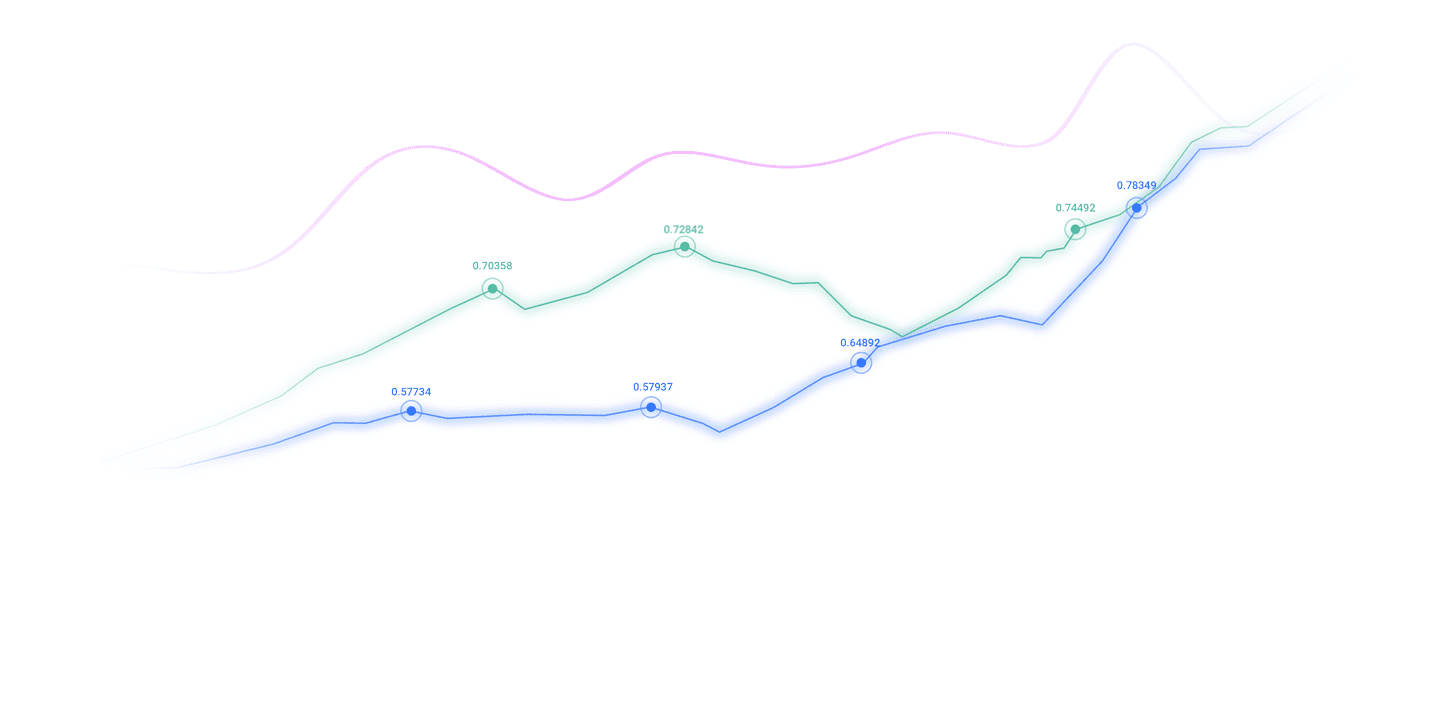

Guide to short-term operation of major currencies

From a technical point of view, the US dollar index rose below 99.40 on Wednesday and the decline above 98.65 was supported, meaning that the US dollar may maintain an upward trend after a short-term decline. If the US dollar index falls above 98.50 today and ...

market analysis2025-06-05

The data is poor and interest rate cuts rise, gold and silver profits fall back

The gold market fluctuated yesterday. The market fell first and then the market rose rapidly, and the position of 3372.6 was given, and the market fell rapidly. The daily line was at the lowest point of 3343.4, and the market rose during the US session. The da...

market analysis2025-06-05

6.5 Gold has strongly moved on, crude oil has fallen sharply. Analysis of today'

The same market, different guidance, different life. The characteristic of novices is that they do not understand technology and enter the market blindly. They only consider one issue each time they trade: they think that as long as they predict the market‘s r...

market analysis2025-06-04

Chinese live lecture today's preview

In the market, breakouts in common patterns are an important means to capture the market start signal. This course will take you to deeply analyze several common technical forms, such as triangle sorting, flag shape, box oscillation, etc., and explain in combi...

market analysis2025-06-04

Check reminder, - June welfare activities highlights!

XM‘s 15th Anniversary Feedback Activity officially started, with 100% cash being deposited and more flexible use of funds. Participate in the online lecture and complete the check-in collection point, and you will have the opportunity to receive an exclusive i...

market analysis2025-06-04

All non-agricultural contacts are coming in June!

On June 6, 2025 (Friday) at 19:00 local time, lock in the XM online live courses and master the market focus - non-agricultural employment data! This course will bring panoramic non-agricultural analysis to help traders fully grasp the logic behind data releas...

market analysis2025-06-04

With the Fed's wait-and-see attitude, the market is waiting for non-agricultural

The macro perspective has recently seen a fierce competition between bulls and bears in the gold market. After hitting the highs of nearly four weeks, it fell back due to the strengthening of the US dollar, and multiple factors have shrouded the fog of uncerta...

market analysis2025-06-04

Gold is still the main focus!

A new round of land census has begun. The land at home has not changed since I was born, and my sister has never been assigned to the land. This policy has been around for almost 40 years. This round of land survey and land division is also to resolve the curr...

market analysis2025-06-04

Gold stands firmly above 3330, and there can still be more adjustments in the da

Gold fell back in the morning and then rose directly, and the center of gravity of the low point was also constantly moving upward. At present, one hour of trading, gold prices have stabilized above the top and bottom conversion level of 3340 in the short term...

CATEGORIES

News

- 【XM Market Analysis】--EUR/USD Analysis: Reasons Behind Weak Rebound

- 【XM Market Review】--USD/PHP Forecast: Continues to See a Major Ceiling

- 【XM Decision Analysis】--GBP/USD Forex Signal: Weakly Bullish Above $1.2376

- 【XM Forex】--BTC/USD Forecast: Bitcoin Price Outlook – Bitcoin Continues to Bounc

- 【XM Decision Analysis】--EUR/USD Forex Signal: Bearish Sentiment as Risks Rise

- 【XM Market Review】--Nasdaq Forecast: Sluggish During Powell Testimony